RoyaltyRange, a leading provider of professional databases used in International Tax and IP Valuations, attracted more than €4M in a joint investment from a diverse group of investors. The round was led by Prague-based VC fund Presto Ventures and was joined by experienced venture capital firms Trind Ventures (€1M) and ZGI Capital (€1M) and a number of angel investors from the Baltic region and Finland. The funding will be used to further grow and deepen the breadth and quality of data used in the company’s product portfolio.

RoyaltyRange focuses on the market for databases – a fast-growing area within International Tax and IP Valuations, which has enjoyed double-digit growth over the past decade, even through economic downturns. Their products are well established in the area of Transfer Pricing, currently a hot topic in International Tax.

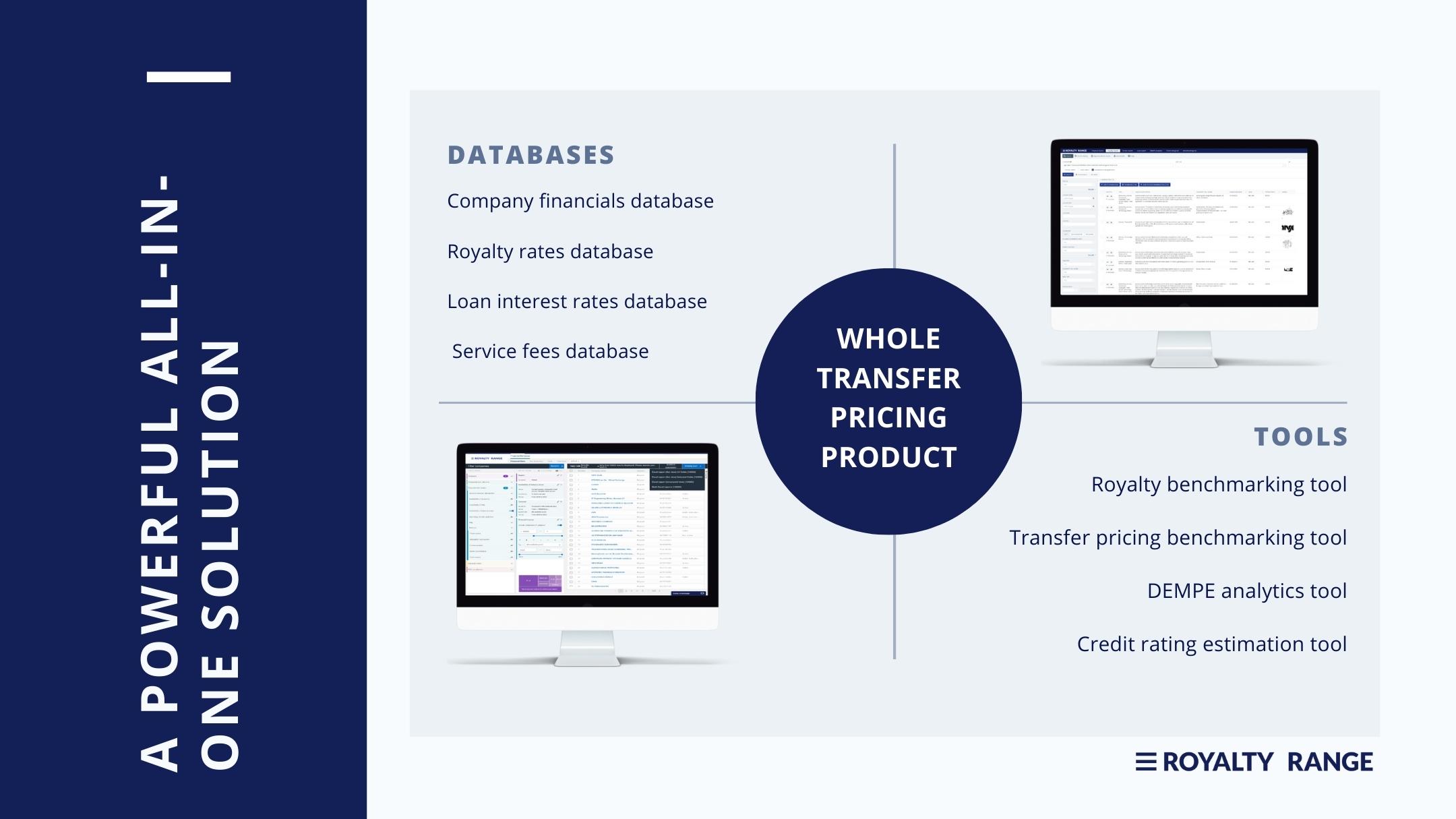

RoyaltyRange’s product portfolio offers 4 databases and 4 data tools – including transactional databases containing data on royalty rates, service fees, and loan interest rates from third-party agreements – and their client base includes numerous firms in more than 70 countries. Many of their clients belong to the largest global accounting firm networks and rely on RoyaltyRange’s products to ensure the reliability of the tax and valuation work they conduct on behalf of multinational enterprises. Notable clients include KPMG, Ernst & Young, Deloitte, PwC, BDO, RSM, and Grant Thornton, as well as numerous tax authorities and international law firms.

The wealth of RoyaltyRange’s subject-matter expertise means our products will continue to be at the vanguard of industry-specific developments. Our customer-driven approach means our products will continue to reflect our customers’ needs and work processes. We are thankful for the continued commitment of our existing investors and excited to work with Presto Ventures, Trind Ventures, and ZGI Capital, whose support will ensure we continue investing in data and applying the latest technology to create more value for our existing and future clients.

Kestutis (Kris) Rudzika, Managing Partner of RoyaltyRange

The global business information market contains a number of earlier-developed solutions that are based on previously used technologies and practices. Hence, International Tax and IP Valuations professionals often have to work with solutions that were not designed with their workflow or data needs specifically in mind. Existing market solutions contain large amounts of data, which does not necessarily translate into useful information. For illustration, out of hundreds of millions of companies, only 10% of the companies would ever be useful to the type of analyses their clients run. This volume of excess data results in extra work, inefficiencies, and potential human error for the professionals working on the analyses. To overcome these challenges, RoyaltyRange uses new proprietary technology and algorithms to obtain and structure data from various sources.

We are extremely proud of the success we’ve had, becoming an important player in a highly complex market. This success is a reflection of our team’s contributions and our core market’s appetite for products that reflect their needs and work-processes. We are well-positioned for continued growth as we expand our range of products in our core International Tax and IP Valuations markets.

Asta Rudzikiene, Director, US & Canada, RoyaltyRange

RoyaltyRange products were designed and built by International Tax and IP Valuation professionals with a view to removing many of the inefficiencies inherent to this market. Moreover, the same type of data published for RoyaltyRange’s core clients may present tremendous synergies with other fast-growing areas such as Compliance, Anti-Money Laundering (AML), Corporate Credit, and Supply-Chain Risk, as well as a significant potential in key Government Sector areas like Tax, Law Enforcement, and Defense.

The extensive tax and technology experience of the team led by Kestutis puts RoyaltyRange in a unique position to develop a solution to change the transfer pricing market. We are excited to participate in this journey accelerating the company’s growth together with other investors.

Kimmo Irpola, Partner at Trind Ventures