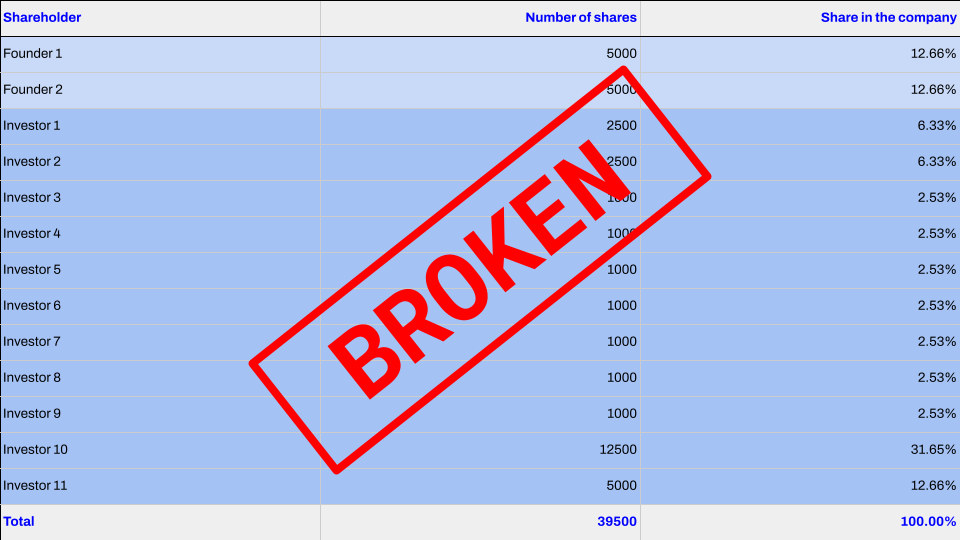

Our previous article was about the importance of an investable cap table. After that article, we got approached by founders asking how to fix a broken cap table. While the best way to avoid this situation is to not give out too much equity in the first place, other tools can be used to solve the problem. In this article, we take a look at some of these tools.

Avoiding Overdiluted Cap Table

To keep the cap table investable, the best solution is to avoid overdiluting it. While dilution is inevitable in equity investments, some ways can be used to reduce the dilution.

Taking in Smaller Rounds

The most common reason for over-dilution is taking in too much cash when the valuation is low. Thus, if the company’s valuation is low and the dilution is significant, it might make sense to divide the funding into two rounds: A smaller one first and a larger one once the company has made progress and the valuation is thus increased.

Taking in smaller rounds makes the most sense in the early stages of the company when achieving specific steps can increase the valuation significantly.

Loans

You do not need to give out equity for loans, so using loans as a part of financing can reduce dilution. Once the valuation is higher, you can take in additional equity with lesser dilution and use the equity to pay out the loan.

Loans are helpful, especially during bridge rounds. However, when using loans, it should be noted that having too much debt in the company can also make it non-investable. This is because the investors want to see their investment going mainly to create new growth for the company; if a significant part of the funding would pay out existing debt, some investors may back off.

Convertible Notes

If the company is in a stage where the valuation can be expected to increase significantly shortly, convertible notes can be used to postpone the valuation event at a later stage and, thus, reduce the dilution.

Like taking in smaller rounds, convertibles are most useful in the early stages of the company.

How to Fix a Broken Cap Table?

Despite all the tools listed above, a cap table needs to be fixed now and then. To make the company investable again, some tools can be used to improve the cap table. It should be noted that all these tools require a cut to the investor’s equity. But keeping the company investable can increase the value of the investment, even if the equity gets cut down.

Transferring Shares to the Founders

Transferring shares from the investors to the founders is probably the most common way to fix an overdiluted cap table. The transfer can happen for free or for a price. Alternatively, the company can also issue new shares to the founders, increasing their stake.

Usually, the transfers happen for free or against a nominal compensation. Transfer at the fair value requires the founder to finance the transaction, which can be challenging. If the transaction is conducted below the fair market value of the shares, the tax consequences should be considered.

Redemption of Shares Held by the Investors

Redeeming shares from the investors reduces the investors’ stake in the company, increasing the founders’ stake.

As with the transfer of shares, the redemption is usually conducted below the company’s fair value. In many jurisdictions, the redemption of shares is treated as a profit distribution; thus, the company should have sufficient equity to carry out the redemption.

Founder Options

Founder options give the founders the right to subscribe to shares in the company at a predetermined price.

The main benefit of the founder options is that the so-called strike price, i.e., the price that the shares are subscribed for in the future, can be set at any level. This enables setting the price on a level that gives the founders sufficient incentive going forward while leaving the investors non-diluted up to that price. For example, if the investors have made their investment at €100/share and the company is now raising funding at €500/share, giving the founders options to subscribe to the shares at €500/share would provide them with a stake in any increase in value while leaving the investors with full right to the €400/share of the value created so far. In other words, the investors would only be diluted in the future increase in value, but they would not be diluted in the value already created.

Founder options may seem complicated, but those are straightforward in practice. Options as such are commonly used; however, adjusting the strike price is a less often considered tool to mitigate the effect of the dilution on the existing shareholders.

Conclusion

An overdiluted cap table makes the company non-investable. While fixing the cap table usually requires the investor to make some concessions for the benefit of the founders, doing so will increase the company’s instability; and thus the value. Knowing the tools for fixing the cap table can help assess different options. Finally, if the broken cap table is the only issue keeping the company from getting funded, usually a solution to it can be found.