A healthy cap table is essential to ensure the company’s investability going forward. In this article, we look into a healthy cap table and how to take the cap table into account in future funding rounds.

Why is cap table management critical?

As investors like to maximize the return on their investment, trying to minimize the valuation is quite common. However, the investors should not be too greedy: Getting greedy in acquiring a stake is not necessarily beneficial to the investor. By taking too much equity, the investor may mess up the cap table so that the founders and key employees are not compensated adequately and/or so that further investment becomes challenging.

Founders should have a sufficient stake in the company. First, they must be motivated to push the company forward. Secondly, they must have enough stake in the game after the funding rounds. Thirdly, there needs to be a problem owner when things become challenging.

For example, if the founders’ stake in a company is 20% and the company’s valuation is 1 meur, the founder has little incentive to push for doubling the valuation in the next two years. Doubling the valuation would make only 100 keur per year, with huge risk; probably something that a talented person could get as an employee for some corporation on a lot lesser risk. And this will keep the prospective future investors out. Also, if the founder’s stake is only 20%, why would the founder spend sleepless nights and pushing 80-hour weeks to save the company while the holders of the remaining owners do nothing (but would still get 80% of any value created)?

Magic of the A-round

So how to keep the cap table investable? My starting point is typically the A-round: After the A-round, the founders need to have still over 50% of the company.

What makes A-round so special? Startups that pass the A-round usually survive the valley of death; potential future funding rounds are more about growing the company. Thus, the risks are higher until this round: Until A-round failure equals liquidation, but failure still lets the company survive from B-round onwards.

Rounds before A-round

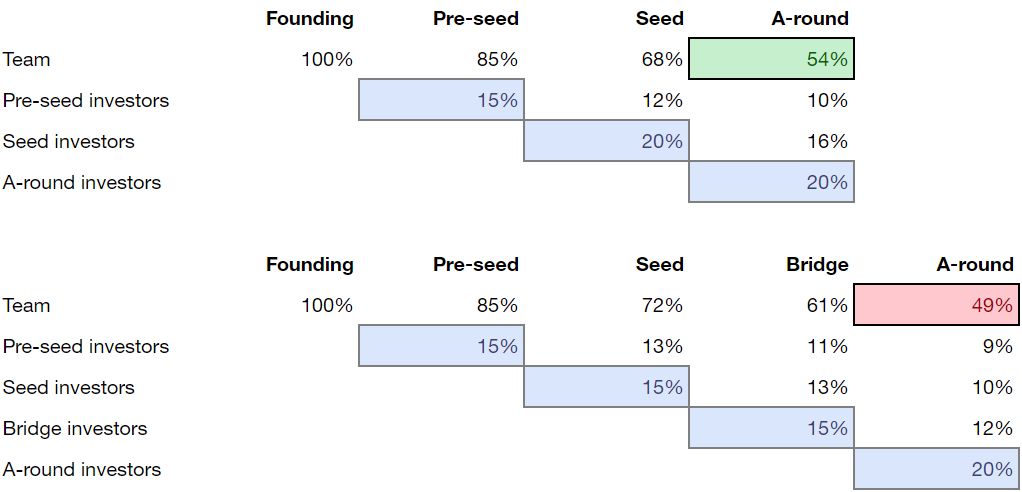

As we lock the post-A-round stake down, we can start building an outline for the funding rounds that keeps the cap table intact. We can expect to give out 20% of the company in A-round. Thus, to keep the founders’ stakes intact, we can dilute a total of 25%-35% in the previous rounds.

If we expect to run a preseed and seed round before the A-round (and leave room for a bridge round, just in case), we must ensure that the dilution stays within limits. For example, 10% equity given out in a preseed round and 20% in a seed round equals 28% dilution, leaving room for one smallish bridge round (below 15%). Preseed dilution of 10% with seed round dilution of 10% would leave more room to maneuver.

You can use some rules of thumb when determining how much equity you can give out (out of 100%) in each funding round before the A-round are presented below. All these also leave room for one bridge round if needed.

Rules of thumb – Round before A-round

- One round 25%

- Two rounds 10% + 20%

- Three rounds 5% + 10% + 15%

What If the Founders Become Over-Diluted?

Now and then, we see situations when the founders have become over-diluted. The over-dilution can be, e.g., due to taking in too much funding with too low valuations or the need for several bridge rounds.

The cap table should not be an unsolvable issue if the company is otherwise investable. I deal with tools for solving a complicated cap table in a separate article.

Simulating Funding Rounds

We have built a spreadsheet that you can use to simulate the dilution of the planned funding rounds. You can find the spreadsheet in our Trind Toolbox.

The size of the funding round should be determined by three elements: Reasonable runway for future plans, current status and opportunity of the company, and cap table management. While securing a long runway by taking down more financing would be tempting, this may cause over-dilution and cap table issues. Thus, you should always consider how to keep your company investable when giving out equity.

[…] previous article was about the importance of an investable cap table. After that article, we got approached by […]