-

Bahn Express Raises €5m to Rapidly Scale Its Automotive Logistics Platform Across Europe

Being one of Finland’s fastest-growing startups, Bahn Express’ platform and logistics solution challenges trucking companies’ monopoly on car transports by cutting transit time for used cars, leasing returns, and one-way rentals from weeks to days. With the new funds, the company will rapidly expand its presence across key EU markets, including Germany, Sweden, Poland, and Denmark, with new markets to follow. Our portfolio company, Bahn Express, an automotive logistics platform for car transport, has announced the successful completion of its five-million-euro funding round. The funds will be used to establish local teams in new European markets, starting with Germany, Denmark, and

-

Yaga Raises €4m to Accelerate Growth of Its Sustainable Fashion Marketplace

Our portfolio company Yaga, the fast-growing online marketplace for secondhand fashion, has raised €4m in a pre-Series A funding round. We participated in the round together with Specialist VC, H&M Group, Startup Wise Guys, and a group of angel investors. Resale platforms are no longer niche – they’re becoming mainstream shopping destinations. The global second-hand apparel market grew by about 15% in 2024, reaching $227 billion, and is forecast to reach $367 billion by 2029*. Yaga is at the centre of this global shift. Over recent years, Yaga has doubled in size annually, reaching a €50m+ GMV run rate. The

-

Aampere Secures €1.6 Million Investment to Become Europe’s Leading Platform for Used Electric Vehicles

E-mobility startup Aampere has successfully closed a €1.6 million funding round to further accelerate its European growth trajectory. The round was led by us, with the participation of Gimic Ventures and several experienced business angels from the mobility sector. Aampere is Transforming the Used EV Market The European market for used electric vehicles is still highly fragmented and often analog, characterized by opaque processes, manual handling, and isolated national solutions. Aampere is breaking these outdated structures by creating a fully digital, Europe-wide platform for selling used electric vehicles. With this, the startup is establishing a sustainable and efficient circular economy

-

eBay to Acquire Tise

Tise’s social-driven innovation unlocks access to the next generation of enthusiasts eBay, a global commerce leader that connects millions of buyers and sellers around the world, today announced that it has entered into a definitive agreement to acquire our portfolio company Tise, a consumer-to-consumer (C2C) social marketplace headquartered in Oslo, Norway. The acquisition will strengthen eBay’s global proposition in C2C, building on the significant momentum it has made in elevating the customer experience. Tise’s social-first, highly intuitive platform will open the door to a vibrant community of Gen Z and Millennial enthusiasts who continue to drive demand across categories. Additionally,

-

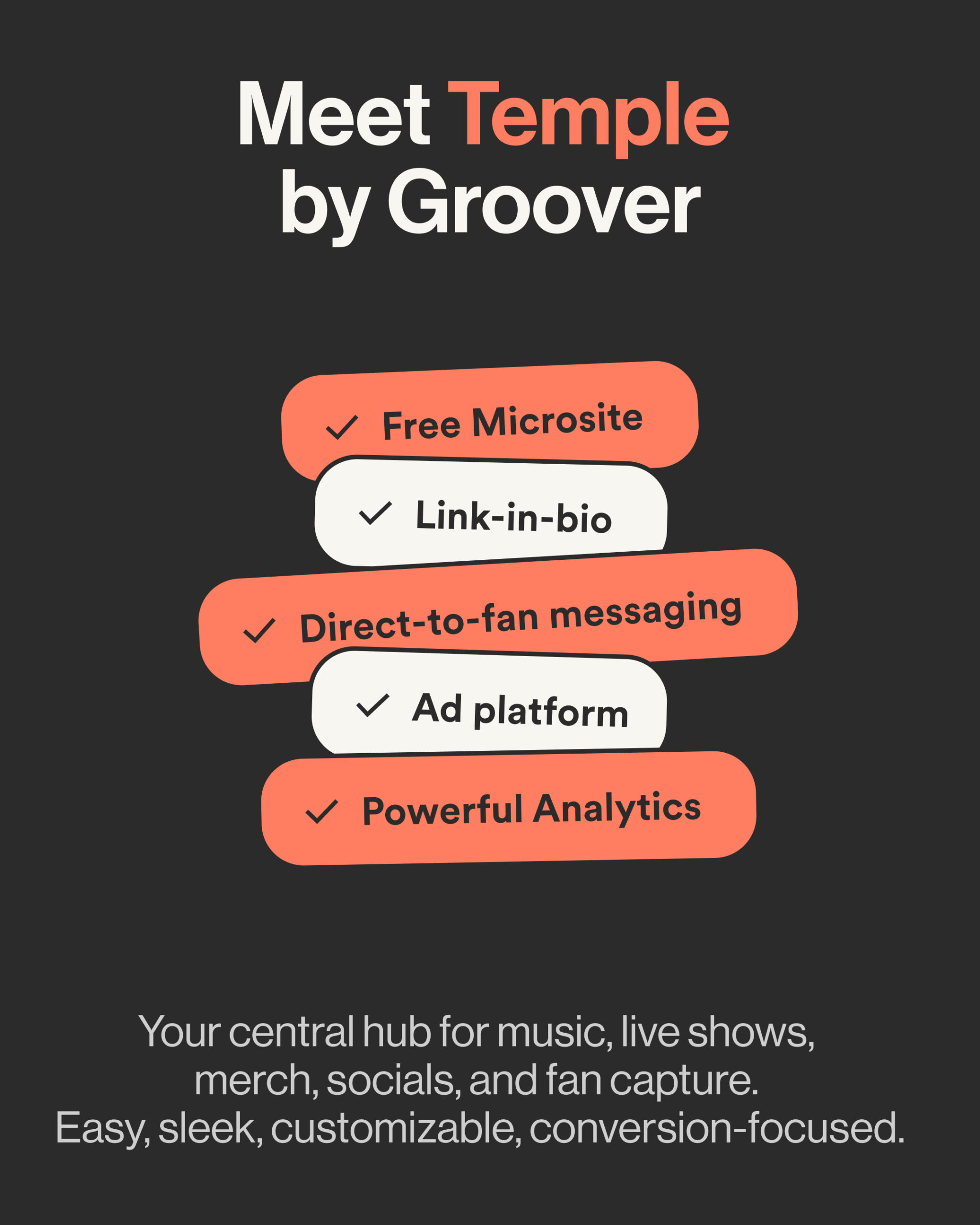

Groover Acquires Temple to Launch Temple by Groover

Trind portfolio company Groover, the leading promotion platform helping independent artists get their music heard, today announced the acquisition of Temple, a fast-growing music tech startup that provides artists with cutting-edge tools to convert listeners into loyal fans. The acquisition marks a major milestone in Groover’s mission to empower artists globally with innovative solutions for promotion, growth, and audience engagement. With this acquisition, Groover is officially launching Temple by Groover, a new suite of tools that complements its existing promotion platform and expands its offering beyond music discovery into fan growth and retention. Temple by Groover includes three direct-to-fan core

-

Trind Invests in Spanish Circular Economy Startup Hamelyn

Trind invests in Hamelyn, a Spanish tech company specializing in the buying and selling of second-hand cultural products, such as books, music, movies, and video games. The company closed a funding round exceeding two million euros, led by Inclimo Climate Tech, and joined by Trind, family offices, and business angels. Driving the Cultural Circular Economy Founded in Madrid four years ago, Hamelyn has established itself as an innovative, responsible, and profitable alternative in the second-hand cultural products sector. Its model integrates proprietary technology, optimized logistics, and a value proposition focused on savings and sustainability. The transaction marks a key milestone

-

Let’s Talk About Founder Burnout

May is Mental Health Awareness Month – so in this blog post, Iryna Krepchuk talks about something that often hides behind pitch decks, investor updates, and product milestones: founder burnout. After eight years in the startup world, I’ve seen firsthand how tightly startup culture is tied to hustle culture. And to be fair, there’s truth to that – to survive (let alone win), you often do need to move fast and push hard. That famous quote, “building a startup feels like jumping off a cliff and building the plane on the way down,” sounds cool – but in reality, your body

-

Why VCs Ghost You at Startup Events — and What to Do About It

You’ve signed up for the event, built your profile, and sent out a stack of meeting requests. A few get accepted. Even fewer turn into real conversations. And some VCs don’t reply at all. It feels personal — but it’s usually not. In this blog post, Iryna Krepchuk discusses why VCs ghost you at startup events and what you can do about it. The Reality Behind the Ghosting Startup events are full of energy, optimism, and opportunity. But behind the scenes, investors are operating with very different goals and workflows. Here’s what most founders don’t realize: Not all VCs use

-

In Spotlight: Yaga – Rewriting the Rules of Pre-Loved Fashion

This time in our blog, we put the spotlight on Yaga, a pre-loved fashion marketplace taking over emerging markets. About Yaga Yaga is an innovative e-commerce platform that specializes in pre-loved fashion, aiming to make sustainable shopping accessible and convenient. Founded in 2017 in Tallinn, Estonia, the company has grown significantly, expanding its operations to emerging markets. Yaga’s platform allows users to buy and sell pre-loved clothing and accessories, promoting a circular economy and reducing the environmental impact of fast fashion. What Yaga Does Yaga operates as a person-to-person marketplace, enabling individuals to list and purchase second-hand items securely. The

-

Trind Invests in the Most Boring Business of 2025, SparkReceipt

SparkReceipt, a Tampere-based pre-accounting software provider, raised a funding round from Trind Ventures with support from the European Union under the InvestEU Fund and Business Finland to accelerate their international expansion. The Most Boring Business of 2025 How stupid is this? Paper, as an invention, was largely driven by the fact that keeping records on clay tablets was awful. Two thousand years later, not much has improved. There’s still no decent accounting software for the hundreds of millions of small business owners globally. Coming from Finland—a promised land of accounting, where structured e-invoices seamlessly transfer between systems—SparkReceipt has learned that,