-

What is a Term Sheet and What Should One Know About It?

Every funding round will be concluded with a set of agreements collectively called investment documents. These are the term sheet, the shareholders’ agreement, and the investment or subscription agreement. In this blog post, we look at some key elements of a typical term sheet. Later, we will dive deeper into the term sheet and address the shareholders’ agreement and investment agreement in upcoming posts. What is a Term Sheet? A term sheet is typically the first document to be signed between the investors and the startup. It is intended to lock down key terms of the investment and related conditions.

-

In Spotlight: RangeForce – Revolutionizing Cybersecurity Training

In today’s digital landscape, organizations face ever-increasing cyber threats. Cybersecurity professionals require up-to-date skills and hands-on training to combat these threats. In this blog post, we look deeper into how our portfolio company RangeForce revolutionizes cybersecurity training. Cybersecurity Simulations and Skills Analysis Platform RangeForce offers an integrated cybersecurity simulation and skills analysis platform that aims to bridge the skills gap in the industry and empower defenders against cyber threats. They do this by addressing the skills gap, cybersecurity tutorials and resources, interactive and gamified learning, and assessing the skills and progress. RangeForce understands the pressing need to address the skills

-

The Power of Collaboration: How Angel Investors and Venture Capitalists Can Cooperate

At Trind, all our partners are angel investors who became venture capitalists. Thus, it is unsurprising that we see tremendous value in cooperation with business angels. In fact, our investment thesis relies heavily on the collaboration between us and angel investors. In this blog post, we dive deeper into the different cooperation opportunities that angel investors and venture capitalists have, resulting in mutual benefits and increased startup success. Referrals, Co-Investments, and Follow-On Funding Angel investors, renowned for their vast networks, possess a unique ability to identify promising startups at their early stages. By partnering with venture capitalists, these angel investors

-

Business information provider RoyaltyRange raised €4M+ from current and new investors

RoyaltyRange, a leading provider of professional databases used in International Tax and IP Valuations, attracted more than €4M in a joint investment from a diverse group of investors. The round was led by Prague-based VC fund Presto Ventures and was joined by experienced venture capital firms Trind Ventures (€1M) and ZGI Capital (€1M) and a number of angel investors from the Baltic region and Finland. The funding will be used to further grow and deepen the breadth and quality of data used in the company’s product portfolio. RoyaltyRange focuses on the market for databases – a fast-growing area within International Tax

-

In Spotlight: Neural DSP

About Neural DSP Neural DSP produces state-of-the-art amplifiers and plugging powered by artificial intelligence and neural networks. Their mission is to empower musicians by democratizing access to world-class sound. Neural DSP was founded in Helsinki, Finland 2017 by Chilean musicians Douglas Castro and Francisco Cresp. Neural DSP was the second company for Douglas, having founded Darkglass Electronics earlier in his career. With both companies, his dream has been the same: To create products that would help musicians take their sound to the next level. The Product Neural DSP aims to develop technology to advance the stage of the art in

-

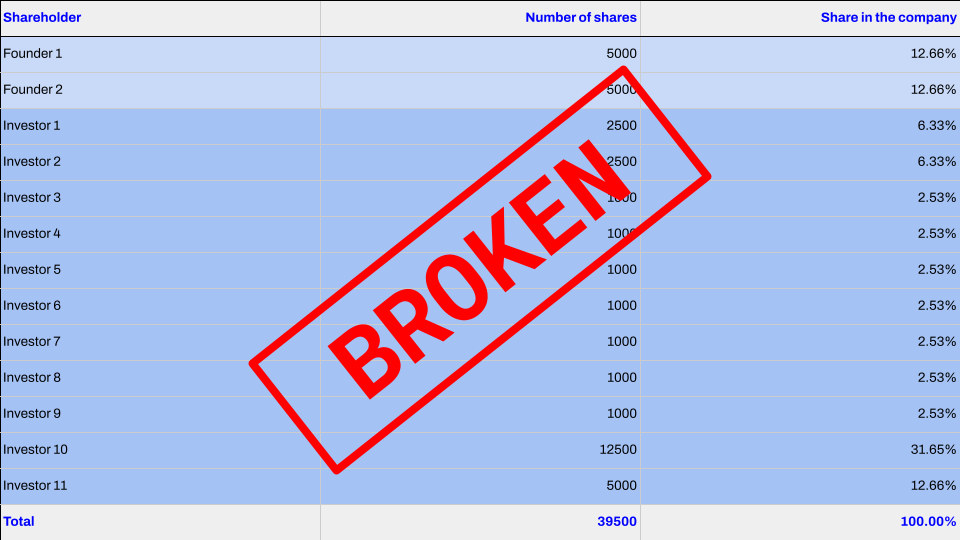

How to Fix a Broken Cap Table?

Our previous article was about the importance of an investable cap table. After that article, we got approached by founders asking how to fix a broken cap table. While the best way to avoid this situation is to not give out too much equity in the first place, other tools can be used to solve the problem. In this article, we take a look at some of these tools. Avoiding Overdiluted Cap Table To keep the cap table investable, the best solution is to avoid overdiluting it. While dilution is inevitable in equity investments, some ways can be used to

-

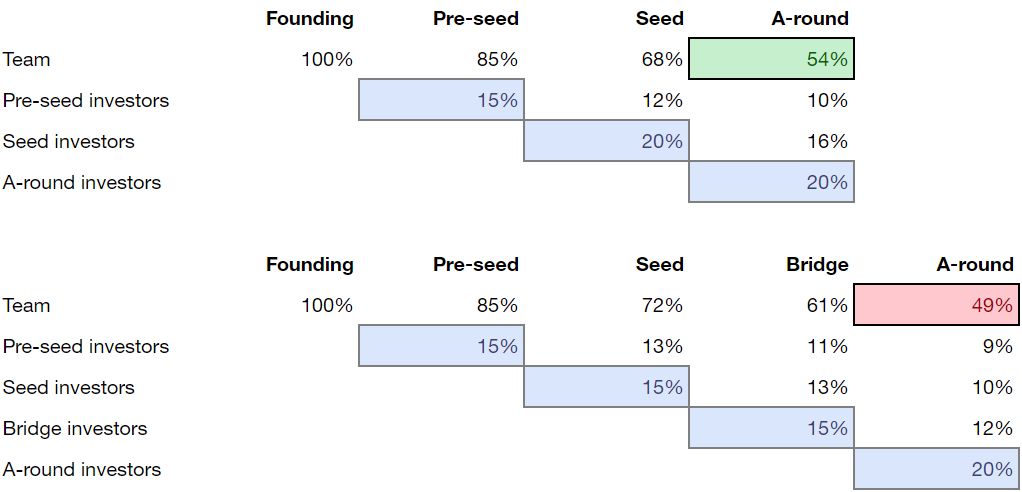

Cap Table Management in Funding Rounds

A healthy cap table is essential to ensure the company’s investability going forward. In this article, we look into a healthy cap table and how to take the cap table into account in future funding rounds. Why is cap table management critical? As investors like to maximize the return on their investment, trying to minimize the valuation is quite common. However, the investors should not be too greedy: Getting greedy in acquiring a stake is not necessarily beneficial to the investor. By taking too much equity, the investor may mess up the cap table so that the founders and key

-

In Spotlight: Boksi

Boksi is a company bridging the brands and the creator economy. They offer a platform where creators and brands realize their creative potential, making influencer marketing and content sourcing simple. Boksi was founded in 2018 by Lasse Laaksonen, Linus Lindgård, Dan Lindholm, and Tomer Atzmon. The company offers a curated network of global content creators who create on-demand photo and video content for brands. Algorithms match content creators with the brands they fit best. In addition, the platform analyses posts of micro-influencers on Instagram and maps the behavior and preferences of their followers. Boksi for Brands For brands, Boksi offers

-

What is a Good CLTV to CAC Ratio?

As a startup founder, growing your customer base cost-effectively is essential. One way to measure the efficiency of your customer acquisition efforts is by looking at the ratio of your customer lifetime value (CLTV) to your customer acquisition cost (CAC). In this blog, we will define CAC and CLTV and provide a general benchmark for a startup’s good CLTV to CAC ratio. We will also discuss the factors that can impact this ratio and provide tips for ensuring that your CLTV to CAC ratio is healthy. Understanding the CLTV to CAC ratio can help you make informed decisions about your

-

RangeForce Raised $20 Million Series B to Boost Its Human Cyber Readiness Platform

Our Fund I portfolio company RangeForce announced the completion of $20 million in financing encompassing a Series B round. This funding will be used to fuel the expansion of the RangeForce human cyber readiness platform. Energy Impact Partners and Paladin Capital Group led the latest round and were joined by KPN Ventures, Lapa Capital Partners, and Lanx Capital, with participation from Cisco Investments. This funding supports our vision to equip the diverse modern workforce with comprehensive cybersecurity upskilling solutions that enable organizations of all sizes to defend against cyber-attacks. Our mission is urgent in light of the global shortage of