-

Evaluating Startup Teams

All investors say they invest in exceptional founders. But how does an investor tell if a team is exceptional? In this blog post, Reima Linnanvirta shares his thoughts on the subject. Quantifiable vs. a Gut Feeling Often, I hear the argument, “I know a great team when I see it.” While I agree with the statement to some extent, it offers very little guidance for the aspiring founder trying to build their team or the VC associate trying to develop their skills. Thus, I try first to focus on quantifiable items, at least to some extent. Experience The relevant experience

-

Raising Money as an Introvert

Participating in startup events and meeting with investors is tough work. And even more so if you happen to be an introvert. In this blog post, Iryna Krepchuk shares her tips to founders on how to raise money as an introvert. When it comes to fundraising, founders can adopt different strategies to reach investors. Naturally, people with extroverted personalities may be more visible and easier to find, but that does not necessarily mean that they’ll be more successful at fundraising. At the end of the day, fundraising is about building trust and meaningful relationships, and introverts often excel at that.

-

How to Find Product/Market Fit Using Metrics

As seed-stage investors, we often invest in companies in search of product/market fit. While some founders have a clear strategy for working their way toward product/market fit, quite often, we see founders who are mystified by the concept and are not systematically working toward it. In this blog post, I share some thoughts on how to systematically work toward product/market fit and use metrics to assess progress. What Is Product/Market Fit? Product/market fit is the sweet spot where your product or service aligns perfectly with the needs and desires of your target market. It means that you’ve found the right

-

How to Get Noticed by VCs – 3 Tips for Founders

In this blog post, Iryna Krepchuk shares three tips for founders on how to get noticed by investors. Before I get into the chances of getting an investment, let me talk about your chances of even getting noticed (especially if you are at a very early stage). When I was applying for a job at a VC, I spent a while knocking on every door without understanding why I might be a fit for that particular fund. Now, I see similar behavior from startup founders who spend little time figuring out whether or not they are the right fit for

-

What is a Cohort Analysis?

When evaluating startups, we review customer acquisition, behavior, and retention. For this purpose, we often ask to see a cohort analysis. In this blog post, we dive a little deeper into what is a cohort analysis, what it tells, how to build one, and what should be taken into account when using it. What is a Cohort Analysis Cohort analysis is a powerful tool for understanding customer behavior over time. It helps businesses identify trends and patterns in customer engagement and retention, which can be used to make informed decisions about marketing, product development, and customer support. How Cohort Analysis

-

What is an Investment Agreement?

In the final part of our investment documents blog series, we will dive into the investment agreement. Whereas the term sheet is the starting point, the investment agreement is sort of the final step. The investment agreement is the document that sets out the investment details. It includes the actions required to close the investment and the structure of the investment itself. Besides, the investment agreement typically consists of the representations and warranties of the company and the existing shareholders. Once the investment agreement has been approved, everything is set for the investment. Investment Requirements for the Investment The investor

-

Startup Shareholders’ Agreement

Startup shareholders’ agreement is a key document in investing in a startup. Known also as the SHA, this document governs the roles and responsibilities of the parties from the investment to the exit of the company (unless, of course, replaced with a new one, e.g., in connection to a funding round). In this article, we look into key clauses that a typical shareholders agreement in a startup with external investors. Shareholders’ Agreement in a Startup A shareholders’ agreement is an agreement between the founders, investors, management shareholders, and the company. In the agreement, the parties set out their agreement on

-

What is a Term Sheet and What Should One Know About It?

Every funding round will be concluded with a set of agreements collectively called investment documents. These are the term sheet, the shareholders’ agreement, and the investment or subscription agreement. In this blog post, we look at some key elements of a typical term sheet. Later, we will dive deeper into the term sheet and address the shareholders’ agreement and investment agreement in upcoming posts. What is a Term Sheet? A term sheet is typically the first document to be signed between the investors and the startup. It is intended to lock down key terms of the investment and related conditions.

-

The Power of Collaboration: How Angel Investors and Venture Capitalists Can Cooperate

At Trind, all our partners are angel investors who became venture capitalists. Thus, it is unsurprising that we see tremendous value in cooperation with business angels. In fact, our investment thesis relies heavily on the collaboration between us and angel investors. In this blog post, we dive deeper into the different cooperation opportunities that angel investors and venture capitalists have, resulting in mutual benefits and increased startup success. Referrals, Co-Investments, and Follow-On Funding Angel investors, renowned for their vast networks, possess a unique ability to identify promising startups at their early stages. By partnering with venture capitalists, these angel investors

-

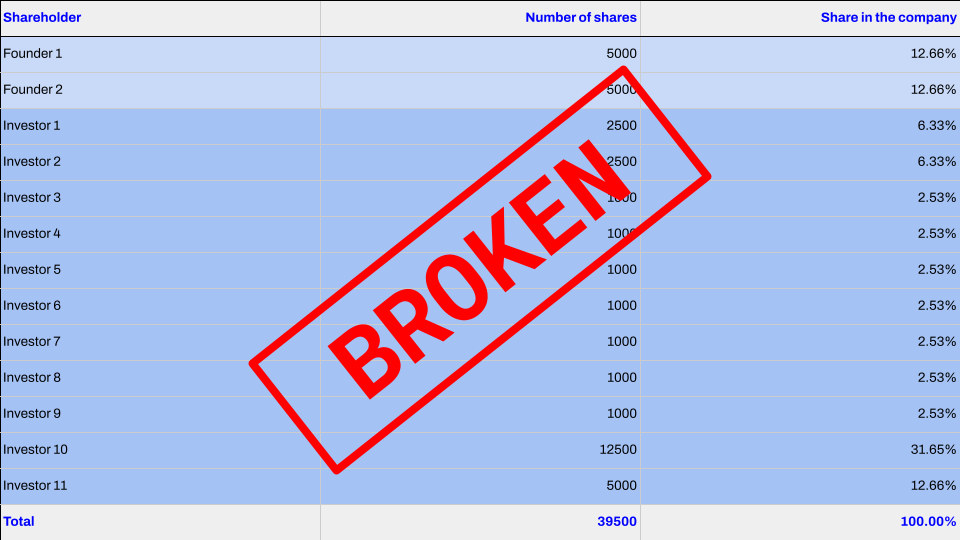

How to Fix a Broken Cap Table?

Our previous article was about the importance of an investable cap table. After that article, we got approached by founders asking how to fix a broken cap table. While the best way to avoid this situation is to not give out too much equity in the first place, other tools can be used to solve the problem. In this article, we take a look at some of these tools. Avoiding Overdiluted Cap Table To keep the cap table investable, the best solution is to avoid overdiluting it. While dilution is inevitable in equity investments, some ways can be used to