-

The Power of Collaboration: How Angel Investors and Venture Capitalists Can Cooperate

At Trind, all our partners are angel investors who became venture capitalists. Thus, it is unsurprising that we see tremendous value in cooperation with business angels. In fact, our investment thesis relies heavily on the collaboration between us and angel investors. In this blog post, we dive deeper into the different cooperation opportunities that angel investors and venture capitalists have, resulting in mutual benefits and increased startup success. Referrals, Co-Investments, and Follow-On Funding Angel investors, renowned for their vast networks, possess a unique ability to identify promising startups at their early stages. By partnering with venture capitalists, these angel investors

-

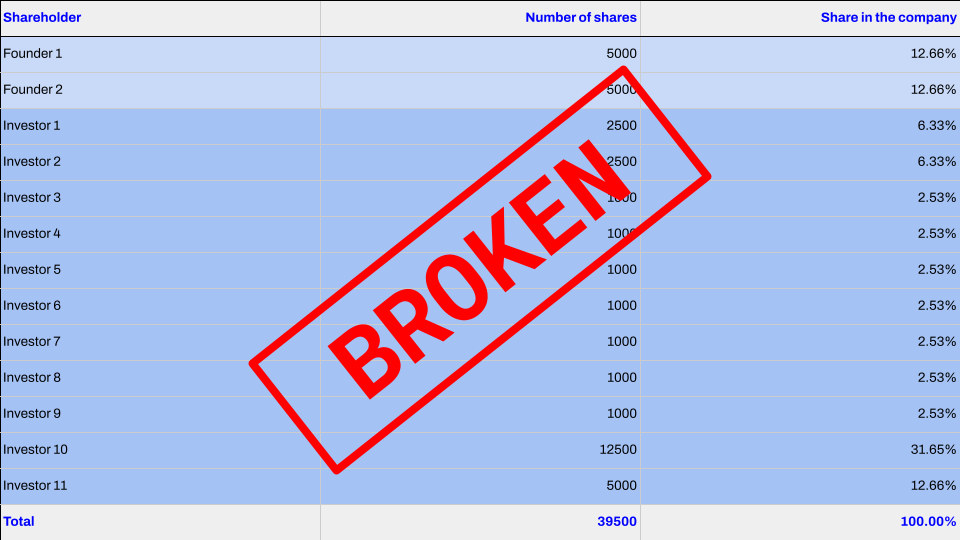

How to Fix a Broken Cap Table?

Our previous article was about the importance of an investable cap table. After that article, we got approached by founders asking how to fix a broken cap table. While the best way to avoid this situation is to not give out too much equity in the first place, other tools can be used to solve the problem. In this article, we take a look at some of these tools. Avoiding Overdiluted Cap Table To keep the cap table investable, the best solution is to avoid overdiluting it. While dilution is inevitable in equity investments, some ways can be used to

-

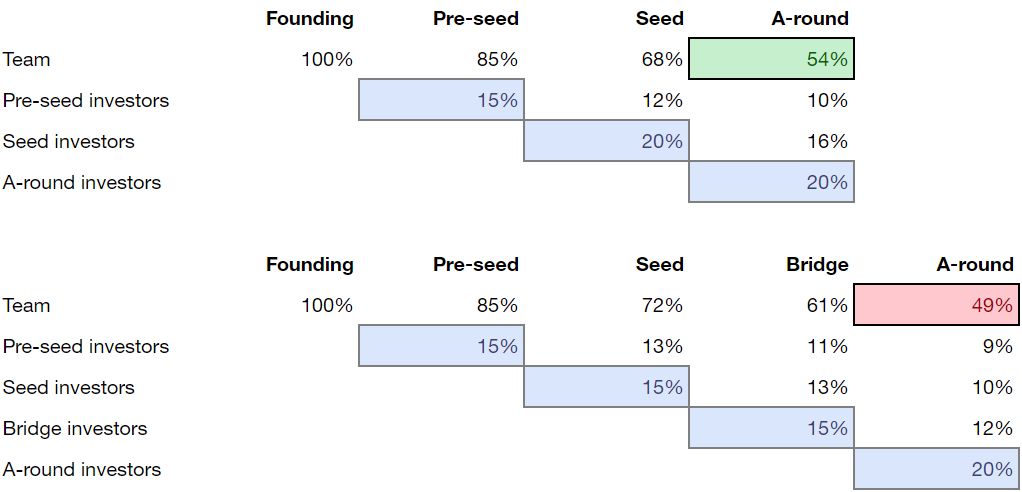

Cap Table Management in Funding Rounds

A healthy cap table is essential to ensure the company’s investability going forward. In this article, we look into a healthy cap table and how to take the cap table into account in future funding rounds. Why is cap table management critical? As investors like to maximize the return on their investment, trying to minimize the valuation is quite common. However, the investors should not be too greedy: Getting greedy in acquiring a stake is not necessarily beneficial to the investor. By taking too much equity, the investor may mess up the cap table so that the founders and key

-

What is a Good CLTV to CAC Ratio?

As a startup founder, growing your customer base cost-effectively is essential. One way to measure the efficiency of your customer acquisition efforts is by looking at the ratio of your customer lifetime value (CLTV) to your customer acquisition cost (CAC). In this blog, we will define CAC and CLTV and provide a general benchmark for a startup’s good CLTV to CAC ratio. We will also discuss the factors that can impact this ratio and provide tips for ensuring that your CLTV to CAC ratio is healthy. Understanding the CLTV to CAC ratio can help you make informed decisions about your

-

What is net revenue retention, why is it important for startups, and how to improve it?

Net revenue retention is a financial metric that measures the amount of revenue a company can retain over a given period. It is an essential indicator of a company’s growth and it’s sustainability and acts as a benchmark for determining its value and attracting additional funding. In this blog post, we take net revenue retention, how it is calculated, why it is essential for venture capital-backed startups, and what the founders can do to improve it. About net revenue retention Net revenue retention is a financial metric measuring the revenue a company can retain over a given period. It is

-

What is product-led growth?

One component we look for in the companies we invest in is product-led growth. But what is product-led growth, and why are we targeting those companies? In this blog post, we will answer these questions. What is product-led growth? Product-led growth is a business model and go-to-market strategy in which a company’s product is the primary driver of customer acquisition, expansion, and retention. This approach is particularly relevant for startups looking to scale quickly and effectively, as it allows for sustainable and predictable growth without the need for heavy sales and marketing efforts. The traditional sales-led model focuses on acquiring

-

What are the key SaaS metrics for a startup?

Trind Ventures invests in companies with a consumer or community component. A lot of these companies are Software as Service (SaaS) companies. When we look at SaaS companies, it is essential to see metrics: We use those to assess the case, and the founders’ can use those to drive and scale the company. This blog post looks at a startup’s key SaaS metrics. SaaS has become a popular business model for many companies, offering businesses a convenient and cost-effective way to access and use software applications. As a result, tracking the right metrics is crucial for the success of a

-

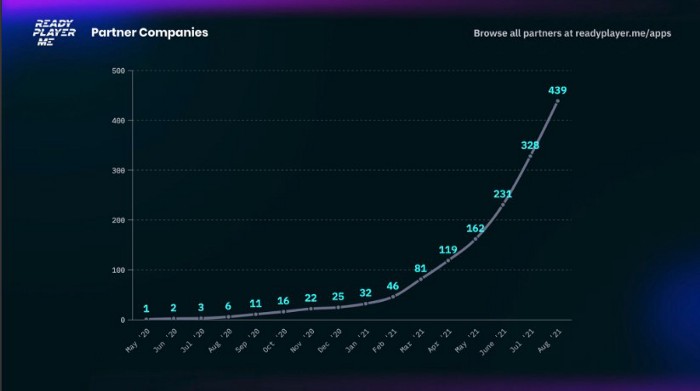

Faster Feedback, Faster Results — Consumer and Community Component Startups and the Secret of High Scalability

Our track record shows that startups with a consumer or community component have the potential for high scalability. But what is the secret behind this scalability, and how the founders can reach this potential? In this blog post, we will demystify the consumer or community component and share some insights on how you as a founder can achieve high data-driven scalability and convince investors to fund your A-round.